Black Friday spending remains a defining force in shaping the holiday shopping season, driving billions in revenue and influencing consumer behavior worldwide. In 2024, spending trends reveal a growing reliance on digital tools, such as interactive catalogs, alongside the increasing popularity of buy now, pay later (BNPL) options. Year-over-year (YoY) growth highlights compiled by Adobe.com showcase the event’s continued dominance, with evolving technological preferences reshaping how shoppers and retailers approach this critical period. Let’s dive into the key insights, including the role of digital catalogs and what they mean for Black Friday spending in 2024.

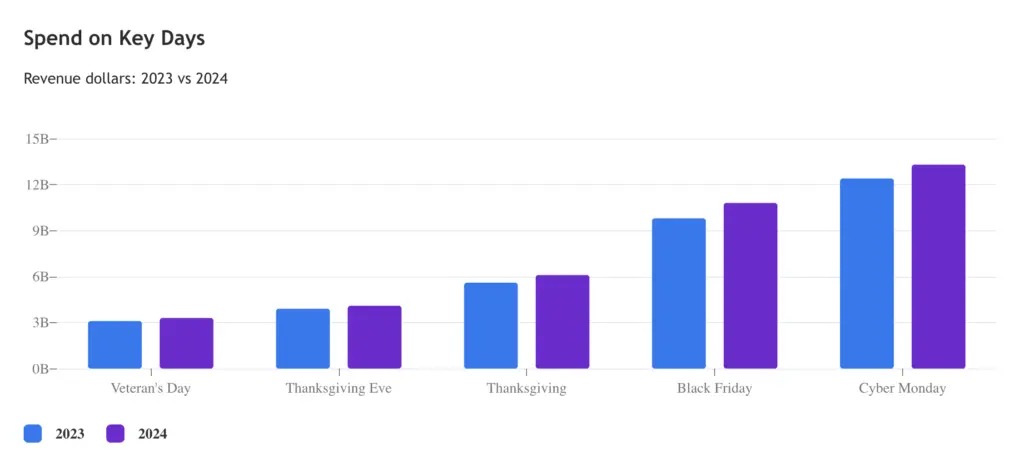

Year-Over-Year (YoY) Black Friday Spend Growth

The holiday season keeps breaking records, and 2024 is no different. Compared to 2023, there has been significant growth in spending on key shopping days. On Black Friday, spending soared to over $12 billion, a 10% increase from the previous year. Cyber Monday followed closely, seeing revenue climb past $13 billion. These figures underscore the importance of strategic discounts and promotions to capture consumer attention.

Source: Adobe.com

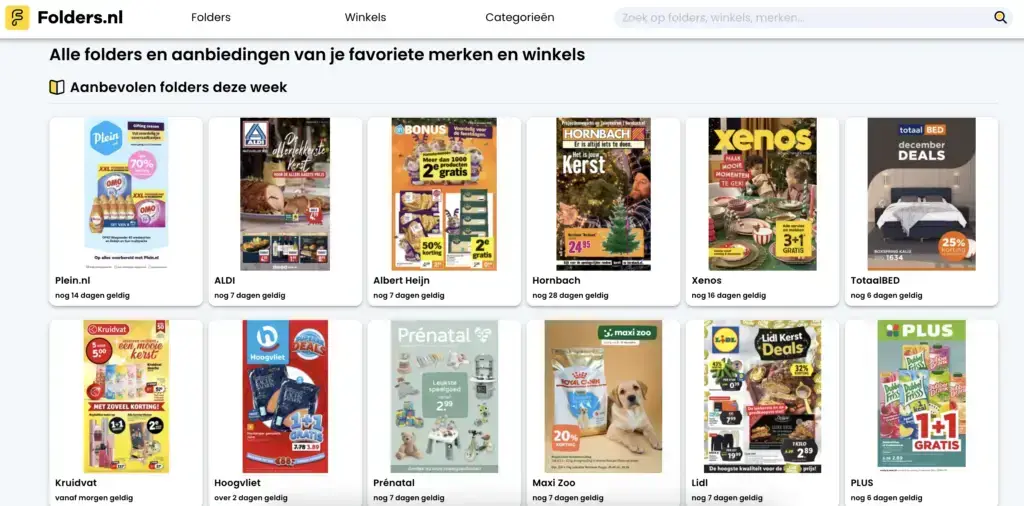

Data from Folders.nl On Digital Catalog Activity

Digital catalogs have become essential for retailers during Black Friday and the broader holiday shopping period because they offer an interactive and highly accessible way to showcase products and drive consumer engagement. Insights from Folders.nl highlight their effectiveness in engaging consumers:

- 13.3% Increase in Publication Opens: Shoppers engaged with digital catalogs more frequently during Black Friday week, with publication opens rising by 13.3% compared to typical activity.

- 27.1% Surge in Clicks: Digital catalogs drove significant engagement, with clicks increasing by 27.1%, highlighting their effectiveness in guiding shoppers toward deals and purchases.

- Sunday Before Black Friday: The Sunday leading up to Black Friday saw the highest activity, with 28.7% more publication opens compared to a regular Sunday, as shoppers prepared for upcoming deals.

- Unusual Weekday Activity: Monday and Tuesday: Traditionally quieter days on Folders.nl, Monday and Tuesday experienced a 20% increase in publication opens during Black Friday week, signaling sustained interest in early promotions.

These statistics highlight how retailers can use digital catalogs to capture attention and guide shoppers to deals. By ensuring content is accessible and engaging, retailers can maximize clicks and conversions, especially during peak shopping weeks.

Cyber Monday Spending Reigns Supreme

While Black Friday sees a frenzy of in-store and online activity, Cyber Monday continues to dominate e-commerce. Offering shoppers the convenience of browsing from home, this day typically drives higher revenues than any other during the holiday season. In 2024, Cyber Monday revenue surpassed Black Friday, highlighting the appeal of extended discounts and tailored promotions targeting online consumers.

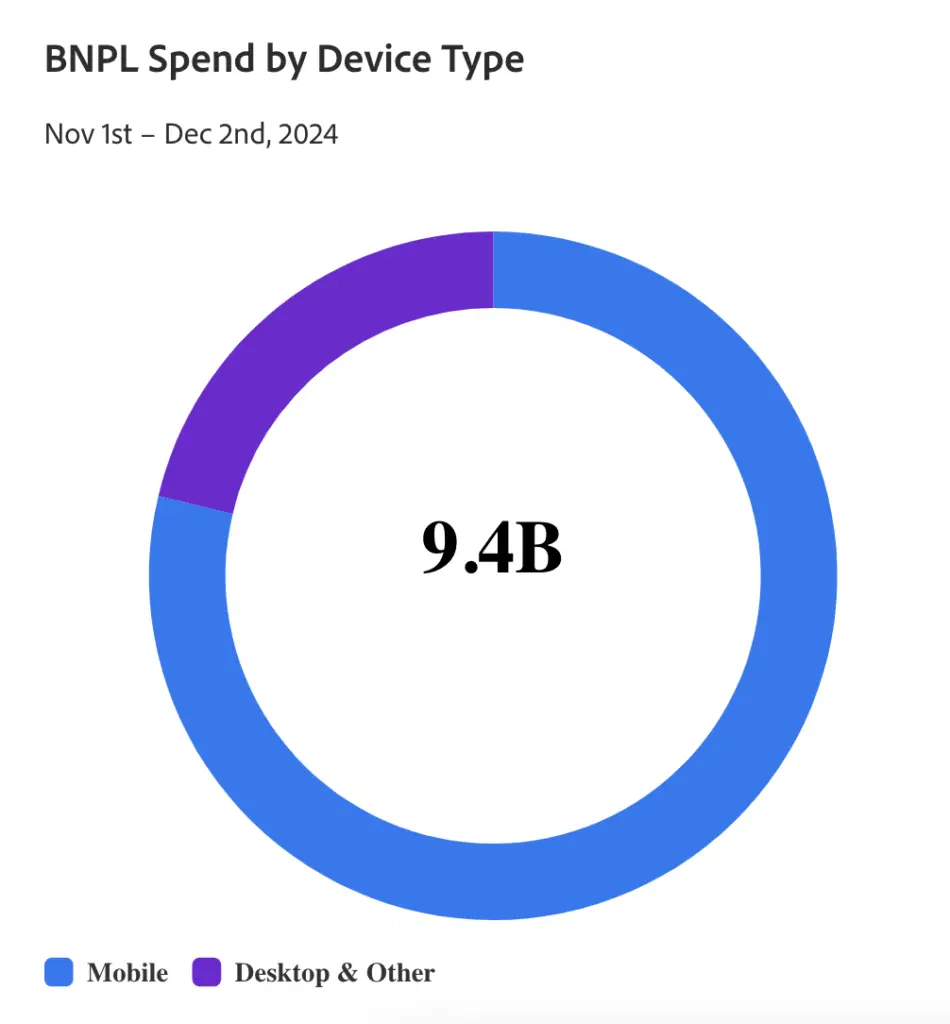

Buy Now, Pay Later (BNPL) Fuels Black Friday Spend

The popularity of BNPL options during the holiday season cannot be overstated. From 2022 to 2024, BNPL spending grew from $13 billion to nearly $20 billion. For many shoppers, BNPL provides a flexible way to manage holiday budgets, particularly for big-ticket items like electronics. Retailers leveraging BNPL options have noted higher conversion rates, especially on high-spend days like Black Friday and Cyber Monday.

Source: Adobe.com

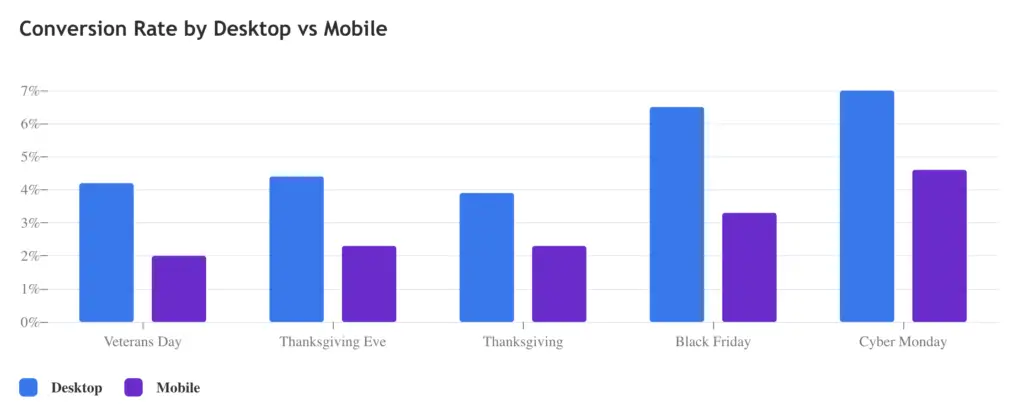

Desktop Shopping Still Dominates

Despite the rise of mobile commerce, desktop buying remains king for large purchases during the holiday season. Shoppers often use desktop devices for more detailed browsing, price comparisons, and checkout processes. Data indicates that desktops accounted for the majority of Black Friday spending, as customers favored larger screens for navigating extensive deals, particularly in electronics and home appliances.

Source: Adobe.com

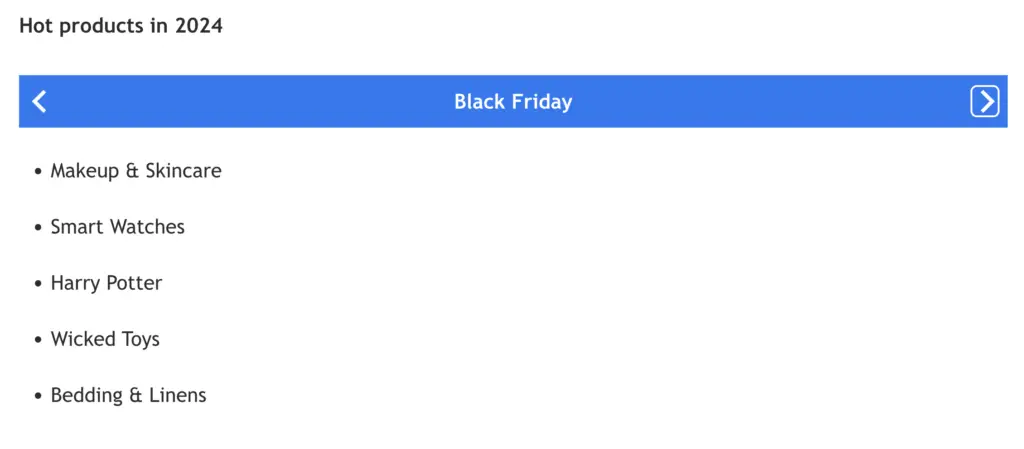

What Are Shoppers Buying This Holiday Season?

Understanding consumer preferences is critical for retailers aiming to maximize holiday revenue. Here’s what drove sales during Black Friday and Cyber Monday 2024:

- Electronics: As always, electronics led the charge, with laptops, gaming consoles, and smart devices topping wish lists. Deep discounts on popular brands drew record-breaking crowds.

- Apparel: While apparel sales remained steady, they were overshadowed by the hype around gadgets and home tech.

- Toys and Gaming: With early promotions and exclusive bundles, this category saw a sharp increase in sales as parents planned ahead for the festive season.

Source: Adobe.com

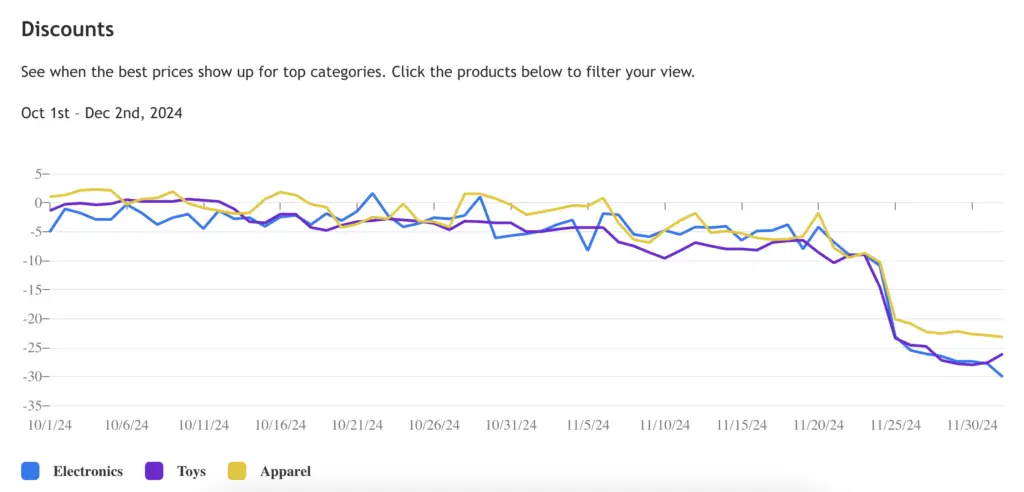

Discount Trends in 2024

Retailers have become more strategic with their offers, focusing on steep discounts for electronics and home appliances while pulling back slightly on fashion-related deals. Flash sales and limited-time offers created a sense of urgency, driving more clicks and purchases during Black Friday week.

Source: Adobe.com

Key Takeaways for Retailers

Black Friday and Cyber Monday are more than just revenue-generating days—they represent opportunities to build long-term customer loyalty. By leveraging trends such as digital catalogs, BNPL, and focusing on popular categories like electronics, retailers can drive higher conversions and stay competitive in the fast-paced holiday market.